BLOG

- home

- Future of Real Estate 2030: What Every Investor Must Prepare For

Future of Real Estate 2030: What Every Investor Must Prepare For

Introduction: The AI Promise vs. Indian Real Estate Reality

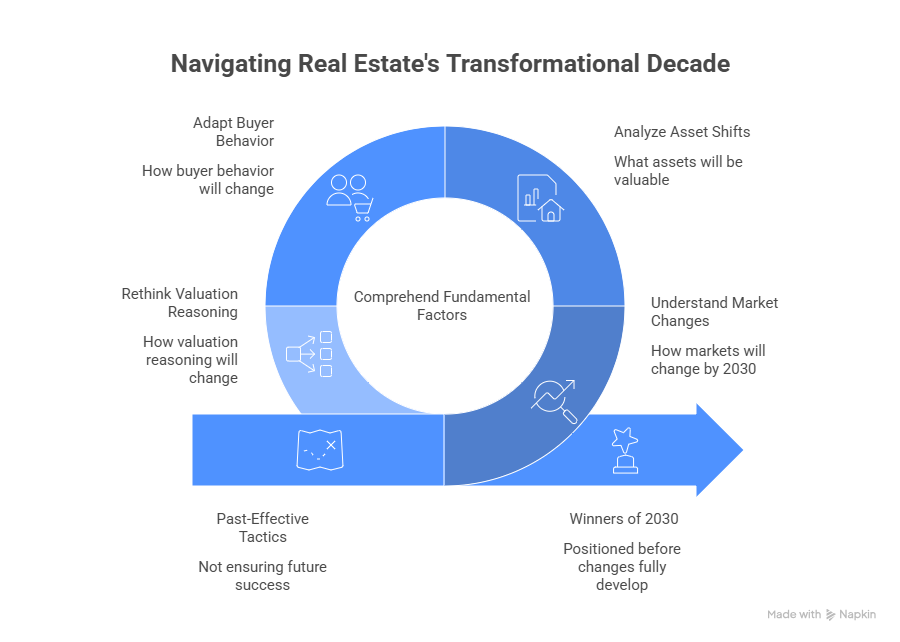

Economic cycles, the expansion of infrastructure, and changes in the population have all influenced real estate. But the decade that ends in 2030 is a structural change rather than merely another stage of prosperity. The development, valuation, purchase, and ownership of property are being rewritten by the convergence of technology, sustainability, global capital mobility, lifestyle redefinition, and governmental regulation.

Thank you for reading this post, don't forget to subscribe!For investors, this says one thing very clearly: past-effective tactics do not ensure future success. Those who comprehend the fundamental factors influencing real estate today and want to position themselves before these changes fully develop will emerge as the winners of 2030.

With an emphasis on how markets, assets, buyer behavior, and valuation reasoning will change by 2030 and what every serious investor needs to be ready for now, this blog decodes the future of real estate from the perspective of an investor.

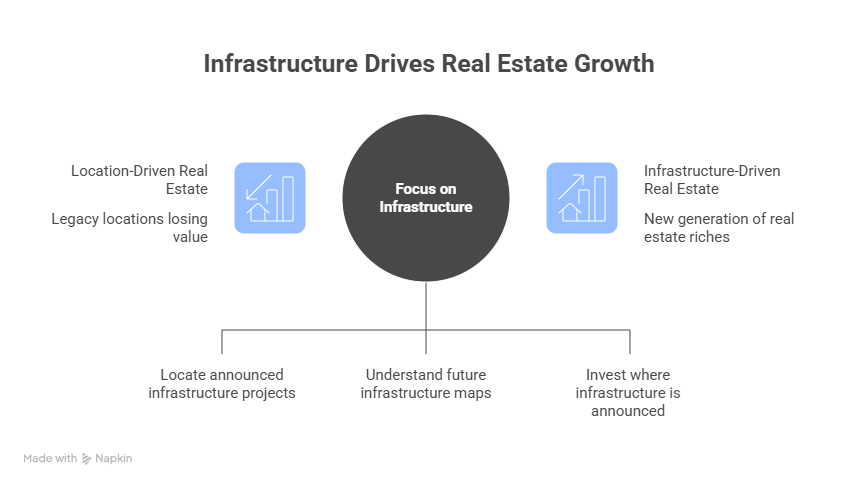

The Shift from Location-Driven to Infrastructure-Driven Growth

In the past, micro-locations like city centers, CBDs, and upscale neighborhoods were used to determine real estate success. Infrastructure will be more important than geography by 2030. Airports, logistical hubs, data centers, expressways, metro corridors, and digital connections are increasingly the main sources of appreciation.

Legacy locations are already losing ground to markets linked to economic infrastructure rather than historical pride. Long before population density rises, early-stage price appreciation is occurring in the areas around new airports, industrial corridors, semiconductor hubs, IT parks, and manufacturing zones.

Investors who comprehend not onlythe present demand but also future infrastructure maps will reap the greatest rewards. Where infrastructure is announced, rather than where it is already saturated, the next generation of real estate riches will be generated.

The Rise of Lifestyle-Led Real Estate Investment

By 2030, square footage and rental return will no longer be the only factors used to evaluate real estate. Value creation will increasingly revolve around lifestyle, wellness, and experience. These days, buyers are buying spaces that promote identity, convenience, community, and health rather than just houses.

The quick growth of branded homes, mixed-use projects, golf communities, wellness townships, and low-density luxury housing can be explained by this change. Properties that combine smart facilities, curated shopping, green areas, walkability, and co-working will fetch high prices.

This implies that properties with experiential value will perform better for investors than those with only functional value. Developments that feel more like ecosystems than structures are the way of the future.

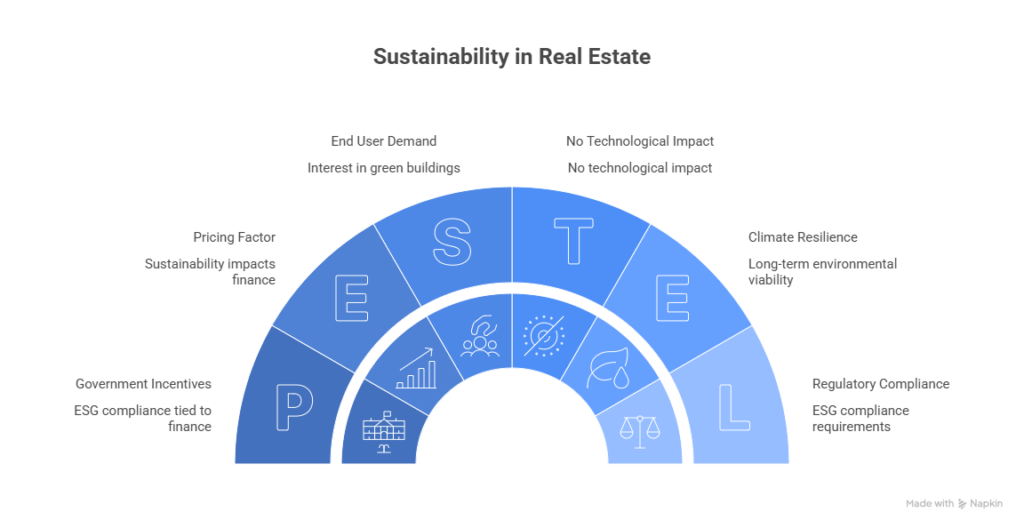

Sustainability Will Become a Pricing Factor, Not a Buzzword

Environmental sustainability is becoming more than just a catchphrase in marketing. Sustainability credentials will have a direct impact on finance, pricing, and liquidity by 2030. Both end users and institutional investors will be more interested in green-certified buildings, energy-efficient residences, water-positive initiatives, and climate-resilient projects.

Financial firms and governments are increasingly tying loan terms, approvals, and incentives to ESG compliance. Properties that don’t adhere to sustainability norms may have fewer financing alternatives, lower resale demand, and greater operating costs.

Investors need to start considering long-term environmental viability in addition to returns when assessing real estate. Sustainable assets will be the most profitable options in addition to being morally right.

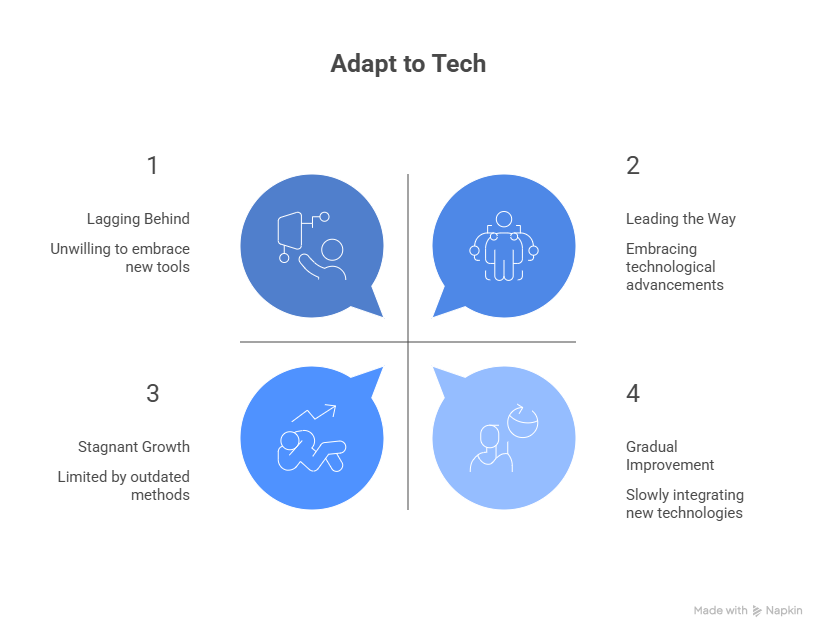

Technology Will Redefine Ownership, Transactions, and Asset Management

By 2030, technology will play a far bigger part in real estate. Property pricing, marketing, transactions, and management will all be altered by blockchain, digital twins, artificial intelligence, and big data.

Pricing will be more transparent and supported by facts thanks to AI-driven appraisal algorithms. Blockchain-based transactions have the potential to increase title clarity and decrease fraud. Smart buildings will automatically optimize energy use, security, and maintenance. Digital documentation and virtual property tours will no longer be optional.

Better asset performance, lower risk, and quicker decision-making are all benefits for investors but only if they adjust. Investors who are opposed to technology might be at a disadvantage in a market that is becoming more and more data-driven

Branded and Institutional Real Estate Will Dominate Premium Segments

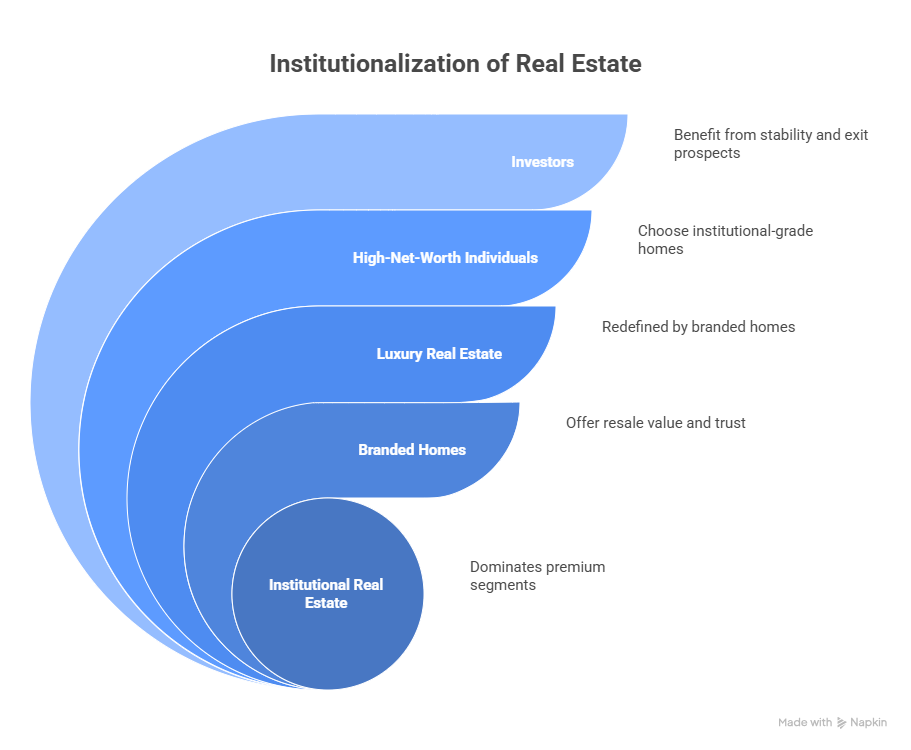

The institutionalization of residential real estate is one of the most significant movements toward 2030. In order to provide reputation, consistency, and long-term value assurance, international brands, luxury homes, hotel chains, and major developers are venturing into residential sectors.

Luxury real estate is being redefined, especially by branded homes. They provide better resale value, increased rental returns, worldwide buyer trust, and expert asset management. High-net-worth individuals and NRIs are increasingly choosing institutional-grade homes.

This change signals a transition from speculative purchasing to professionally managed, brand-backed assets. Investors will benefit from increased stability and exit prospects when they partner with reputable developers and international brands.

Rental Housing and Yield-Based Investing Will Gain Momentum

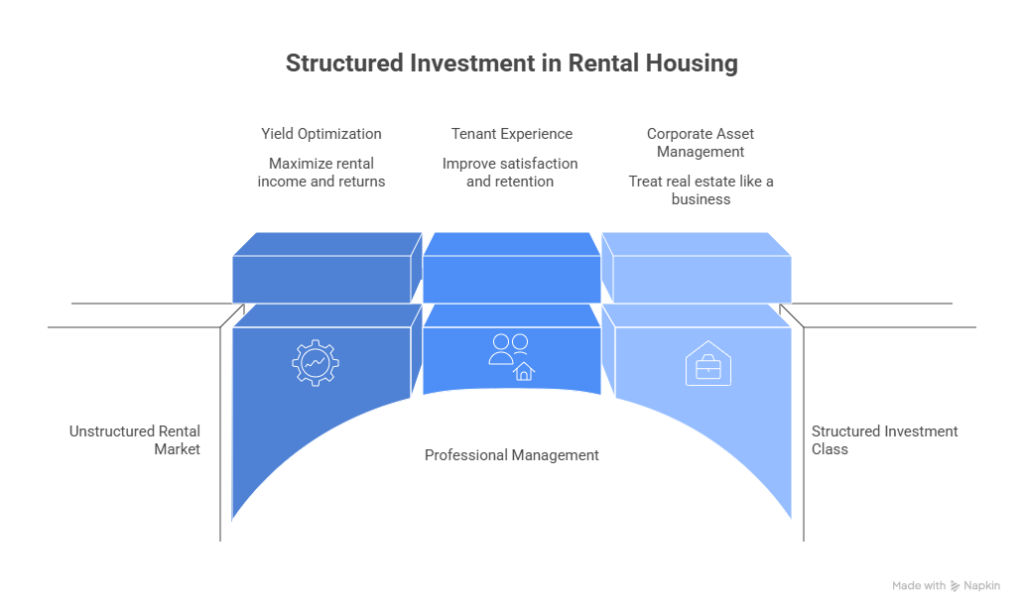

Rental housing will transition from an unstructured market to a structured investment class by 2030. Long-term demand for high-quality rental accommodation is being driven by urban migration, delayed homeownership, flexible work schedules, and growing real estate costs.

Co-living, serviced flats, student housing, managed rentals, and elder living will become popular asset types. Predictable cash flows will become more important to investors than speculative capital growth.

This is a profound change in perspective. Instead of being viewed as a passive investment, real estate will be handled more like a corporate asset. The future rental economy will be dominated by those who comprehend professional management, yield optimization, and tenant experience.

Tier-2 and Emerging Cities Will Create the Next Wave of Wealth

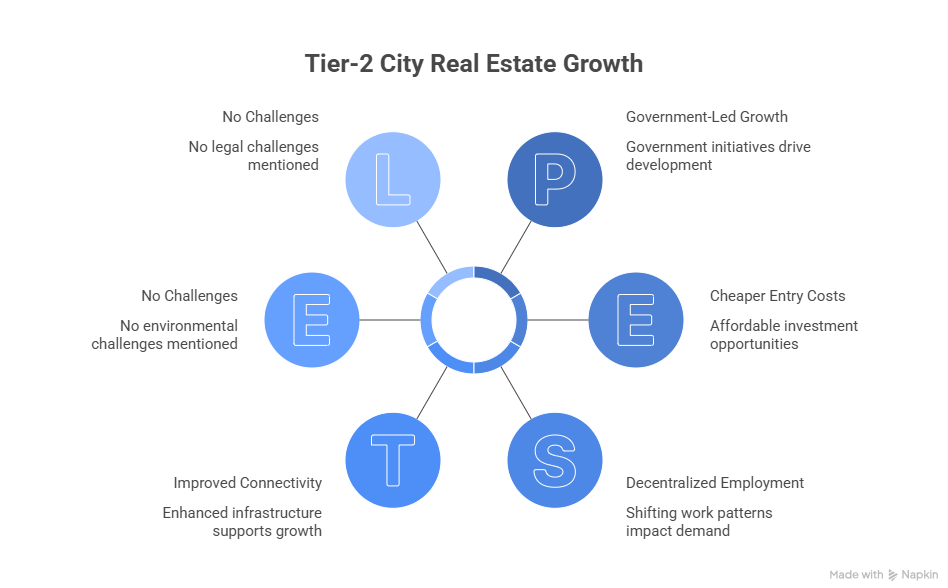

Metro areas will still be significant, although Tier-2 and developing urban centers will increase at the fastest rate by 2030. Demand is expanding outside of conventional cities due to improved connectivity, decentralized employment, cheaper entry costs, and government-led growth.

These markets give scale, affordability, and the opportunity for long-term appreciation that metro areas can no longer offer. As these cities develop into major economic centers, early investors stand to gain from exponential development.

Timing and choice are crucial. While not every growing city will be successful, those that are in line with industry, infrastructure, and talent inflow will fare noticeably better.

Regulation and Transparency Will Strengthen Investor Confidence

A more accountable and transparent real estate sector is now possible because of regulatory changes like RERA. By 2030, investor risk will be significantly decreased by digital governance, disclosures, and compliance.

Long-term involvement in real estate markets, foreign investment, and institutional capital will all increase as a result. In contrast to unstructured and non-compliant developments, organized players will increase their market share.

Real estate is becoming a safer and more developed investment sector for investors due to fewer shocks, more transparent timeframes, and more dependable project execution.

Conclusion: The Investor Mindset Must Evolve Before 2030 Arrives

The future of real estate is about how to think, not just where to put your money. Investors who prioritize experience-driven assets, embrace technology, comprehend infrastructure, respect sustainability, and have a long-term outlook will be successful by 2030.

Wealth will still be generated by real estate, but only for those who adapt to it. Investors that are strategic, forward-thinking, and well-informed will dominate the next ten years as they get ready for the realities of the future.

It will be too late for those who wait for clarity. The most astute investors are already setting themselves up for the future of real estate.

Speak to us about your property plans, we’re here to guide you.