BLOG

- home

- Land vs Apartment vs Commercial: What Delivers the Highest Returns?

Land vs Apartment vs Commercial: What Delivers the Highest Returns?

Real estate investment remains one of the most reliable wealth-building strategies, but choosing between land, apartments, and commercial properties can significantly impact your returns. Each asset class offers distinct advantages, risks, and profit potential. This comprehensive analysis examines which investment delivers the highest returns based on current market data, investment timelines, and individual financial goals.

Thank you for reading this post, don't forget to subscribe!Land Investment: The Long-Term Appreciation Play Return Potential: 8-12% annually (primarily through appreciation)

Raw land represents the purest form of real estate investment—you’re buying the asset without structures, tenants, or maintenance concerns. Historically, well-located land has delivered substantial returns, particularly in growth corridors and developing areas.

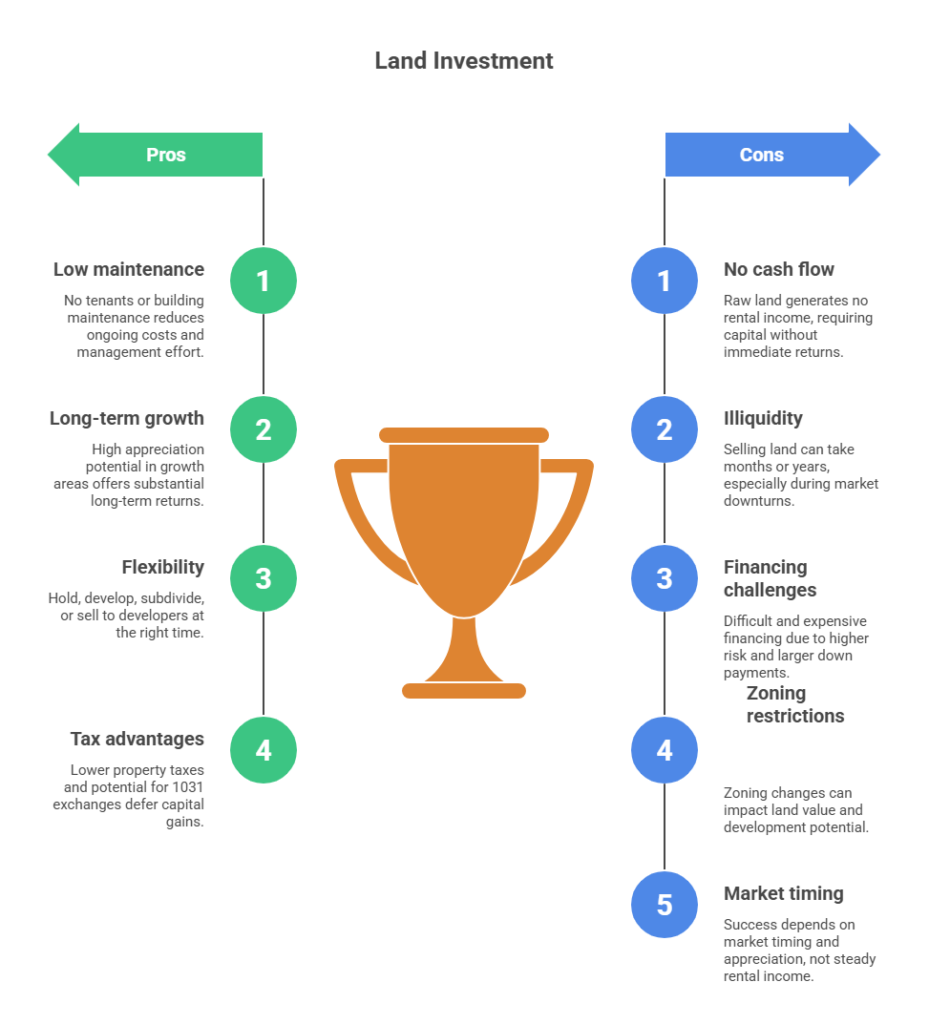

Advantages of Land Investment:

Land offers several compelling benefits that attract investors seeking lower maintenance and long-term growth. There are no tenants to manage, no building maintenance costs, and no property management headaches. The holding costs remain relatively low compared to income-generating properties, typically limited to property taxes and occasional land maintenance. Land also provides incredible flexibility—you can hold it indefinitely, develop it yourself, subdivide it for higher returns, or sell to developers when the timing is right.

The appreciation potential in high-growth areas can be exceptional. Land in the path of development often experiences exponential value increases as infrastructure improves and demand rises. Additionally, land investments offer significant tax advantages, with lower property taxes than improved properties and potential for 1031 exchanges to defer capital gains.

Disadvantages of Land Investment:

However, land investment comes with notable challenges. There’s no immediate cash flow since raw land generates no rental income, requiring investors to hold capital without ongoing returns. The illiquidity factor is significant—land can take months or years to sell, especially during market downturns. Financing is also more difficult and expensive, as lenders view land as higher risk, often requiring larger down payments (30-50%) and charging higher interest rates.

Zoning restrictions and regulatory changes can severely impact land value and development potential. Market timing becomes critical since you’re entirely dependent on appreciation rather than steady rental income to generate returns.

Land investment works best for patient investors with long time horizons (10+ years), those with substantial capital who don’t need immediate cash flow, and investors who can identify emerging growth areas before development occurs. It’s ideal for those seeking to minimize management responsibilities while building long-term wealth.

Apartment Investment: The Cash Flow Champion Return Potential: 10-15% annually (rental income plus appreciation)

Residential apartment investments – whether single units, small multifamily properties, or apartment buildings – have consistently delivered strong returns through a combination of rental income and property appreciation.

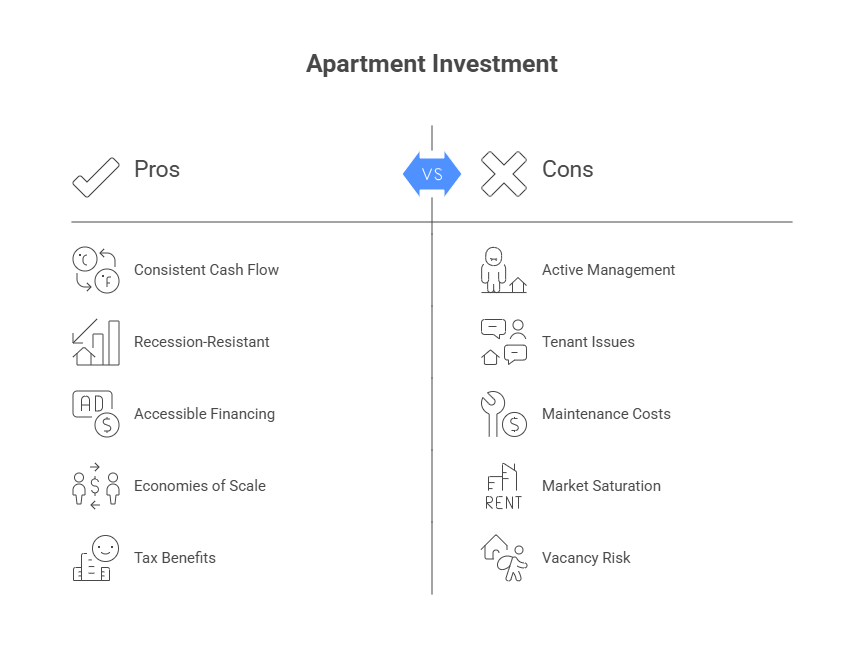

Advantages of Apartment Investment:

partments generate immediate and consistent monthly cash flow through rental income, providing passive income that can cover mortgage payments and operating expenses while generating profit. The demand for rental housing remains strong and relatively recession-resistant, as people always need places to live regardless of economic conditions.

Financing for residential properties is more accessible, with lower down payment requirements (15-25%) and better interest rates than commercial properties or land. Apartments also benefit from economies of scale – multifamily properties spread operating costs across multiple units, improving overall returns. The management systems are well-established, with numerous property management companies available to handle day-to-day operations.

Tax benefits are substantial, including depreciation deductions, mortgage interest deductions, and the ability to deduct operating expenses. The forced appreciation potential through property improvements and rent increases gives investors more control over returns compared to raw land.

Disadvantages of Apartment Investment:

Active management is required, whether you handle it yourself or hire a property manager, creating ongoing responsibilities. Tenant issues, including late payments, property damage, and turnover costs, can significantly impact returns. Maintenance and repair costs are constant and can be unpredictable, particularly for older properties.

Market saturation in some areas has led to increased competition and lower rental yields. Rising property insurance costs and property taxes can erode profit margins over time. Vacancy risk is real – empty units generate no income but still incur expenses.

Best For:

Apartment investments suit investors seeking regular monthly cash flow, those willing to manage or oversee property management, investors who want a balance between income and appreciation, and those looking to leverage financing to build a real estate portfolio. It’s excellent for creating passive income streams that can replace or supplement employment income.

Commercial Property Investment: The High-Risk, High-Reward Option

Return Potential: 12-20% annually (higher rental income, longer leases)

Commercial real estate includes office buildings, retail spaces, industrial warehouses, and mixed-use developments. This asset class typically delivers the highest absolute returns but comes with increased complexity and risk.

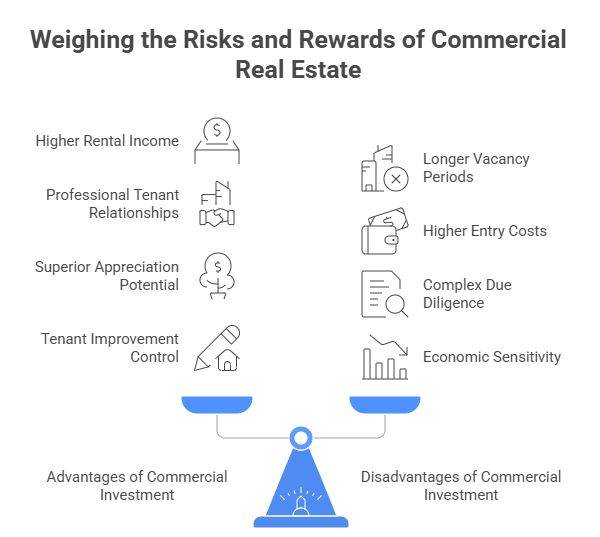

Advantages of Commercial Investment:

Commercial properties command higher rental rates per square foot than residential properties, generating superior cash flow. Lease terms are longer (typically 3-10 years), providing income stability and reducing turnover costs. Triple-net leases common in commercial real estate shift maintenance, insurance, and tax responsibilities to tenants, dramatically reducing landlord expenses.

Professional tenant relationships tend to be more businesslike, with companies motivated to maintain their locations for brand reputation and operations. Commercial properties often offer superior appreciation potential in prime locations, particularly in growing business districts. The ability to increase property value through strategic improvements and tenant mix optimization gives investors more control over returns.

Disadvantages of Commercial Investment:

Higher entry costs are prohibitive for many investors, typically requiring $500,000 to several million dollars for purchase. The complexity of due diligence, lease negotiations, and property management requires specialized knowledge or expensive professional services. Economic sensitivity is significant – commercial properties suffer more during recessions when businesses close or downsize.

Vacancy periods are longer and more costly than residential properties, sometimes lasting months or years. Finding qualified tenants with strong financials requires extensive vetting and negotiation. The financing requirements are more stringent, typically requiring 25-40% down payments and demonstrable commercial real estate experience.

Tenant improvement costs and build-out expenses can be substantial, particularly when securing new tenants. Market cycles in commercial real estate are more pronounced, with longer recovery periods following downturns.

Best For:

Commercial property investment works best for experienced investors with substantial capital ($500,000+), those who understand business and commercial lease structures, investors who can weather longer vacancy periods, and those seeking maximum cash flow with less hands-on management than apartments. It’s ideal for portfolio diversification and investors who can identify emerging commercial districts before they reach peak values.

Comparing Returns: The Numbers That Matter

To determine which investment delivers the highest returns, we need to examine real-world scenarios based on a $500,000 investment:

Land Investment Scenario:

Purchasing land in a growth corridor outside a major metropolitan area, you might acquire 5-10 acres for $500,000. With 8-10% annual appreciation, your land could be worth $800,000 to $1,000,000 in 7-10 years. However, with no rental income and holding costs of approximately $5,000-$10,000 annually for taxes and maintenance, your net return depends entirely on appreciation and your ability to time the market correctly. The internal rate of return over 10 years might be 8-12%, assuming successful sale timing.

Apartment Investment Scenario:

A $500,000 investment (25% down payment) can purchase a $2 million multifamily property. With a 6% cap rate, you’d generate $120,000 in net operating income annually. After mortgage payments of approximately $90,000 yearly, you’d have $30,000 in annual cash flow (6% cash-on-cash return). Combined with 3-4% annual appreciation on the full property value and mortgage paydown, your total return could reach 12-15% annually, with the added benefit of monthly cash flow from day one.

Commercial Investment Scenario:

The same $500,000 investment (25% down in this case) could purchase a $2 million commercial property with a 7-8% cap rate. Net operating income of $140,000-$160,000 annually, minus mortgage payments of approximately $90,000, yields $50,000-$70,000 in annual cash flow (10-14% cash-on-cash return). With potential 4-6% annual appreciation and mortgage paydown, total returns could reach 15-20% annually. However, this assumes consistent occupancy and stable tenant relationships.

The Verdict: Which Investment Wins?

The answer depends entirely on your investment profile, risk tolerance, and timeline:

For Maximum Total Returns:

Commercial property typically delivers the highest returns (15-20% annually) but requires the most capital, expertise, and risk tolerance. Experienced investors with substantial resources often find commercial real estate to be the most lucrative option.

For Best Risk-Adjusted Returns:

Apartment investments offer the optimal balance (10-15% annually) of cash flow, appreciation, and manageable risk. For most investors, particularly those building their first significant real estate portfolio, apartments provide the best combination of returns and stability.

For Lowest Effort and Long-Term Growth:

Land investment (8-12% annually) suits passive investors who can afford to wait years for appreciation and don’t need immediate income. While returns may be lower on an annual basis, the minimal management requirements and potential for exponential gains in the right location make land attractive for specific investor profiles.

Key Factors Influencing Your Decision

Several critical factors should guide your investment choice beyond simple return percentages.

Capital Available:

Land requires the least ongoing capital but generates no income. Apartments offer the best financing terms. Commercial properties demand the most upfront capital and reserves.

Time Commitment:

Land requires minimal time investment. Apartments demand moderate management attention or management fees. Commercial properties need significant time for tenant relations and strategic planning, unless fully outsourced.

Risk Tolerance:

Land carries market timing risk with no income buffer. Apartments offer moderate risk with diversified tenant base. Commercial properties carry higher business cycle risk but potentially higher rewards.

Investment Timeline:

Land suits very long-term holders (10+ years). Apartments work for medium to long-term investors (5+ years). Commercial properties require long-term commitment but offer stronger short-term cash flow.

Market Knowledge:

Land requires excellent location analysis and development trend awareness. Apartments benefit from local rental market expertise. Commercial properties demand deep understanding of business trends and commercial lease structures.

Creating a Diversified Real Estate Strategy

Many successful real estate investors don’t choose just one asset class but strategically combine all three for portfolio diversification and optimized returns:

Start with apartment investments to generate immediate cash flow and build equity. Use cash flow from apartments to fund land acquisitions in emerging growth areas. Transition to commercial properties as capital and experience grow. Hold land for long-term appreciation while apartments and commercial properties generate operational income. This diversified approach mitigates risk while maximizing overall portfolio returns.

Making Your Investment Decision

The question of which investment delivers the highest returns cannot be answered universally because “highest returns” means different things to different investors. Commercial properties typically offer the highest absolute returns but require substantial capital and expertise. Apartments provide the best risk-adjusted returns for most investors, combining steady cash flow with appreciation potential. Land offers patient investors the possibility of extraordinary returns with minimal effort but no guarantee of timing.

The true answer lies in aligning your investment choice with your financial goals, available capital, risk tolerance, time horizon, and willingness to actively manage investments. For most investors starting their real estate journey, apartments represent the sweet spot of manageable risk, accessible financing, and strong returns. As your portfolio grows, diversifying into commercial properties and strategic land holdings can optimize your overall real estate returns.

The highest returns ultimately come not from choosing the “best” asset class but from thoroughly understanding your chosen investment type, buying in the right markets at the right time, and managing your investments effectively over the long term. Whether you choose land, apartments, or commercial property, success in real estate investment requires due diligence, patience, and strategic thinking.

Speak to us about your property plans, we’re here to guide you.